The Headline Examples Everyone Cites (For Good Reason)

Walmart's public numbers made investors sit up. Azure AI and an autonomous loop pushing granular forecasts at store level, ingesting 2.5 petabytes daily, slashing inventory 28% while revenue grew 4.2% year over year. The story isn't just the models. It's the orchestration—edge processing, supplier APIs, and policy automation that routed around Red Sea disruptions before they were headline news. That's operational foresight, not hindsight postmortem.

Procter & Gamble's Olay engine, powered by IBM Watson and Palantir, carved safety stock in half and bumped beauty segment sales by 7%. It wasn't magic. It was disciplined: SKU rationalization, promotion-aware forecasts, and a loop that learned from misses. During U.S. port strikes, the system predicted 20% demand shifts and adjusted sourcing. Revenue preserved. Cash unfrozen.

Unilever's SAP IBP plus custom ML stack trimmed error by 55% and freed €800 million. The kicker was commodity foresight. Anticipating cocoa shortages let procurement hedge early, saving 12% on cost and nudging margins three points. Forecasting isn't just what customers buy—it's what your suppliers can actually deliver and at what cost.

What's Changed in 2026

Three things: the cost to get started, the quality of signals, and the cultural willingness to trust machines with big levers. Hyperscalers have made plug-and-play real enough for midsize firms. Social sentiment, weather, and geopolitics feed models with texture, not just volume. And after a few very public wins—and a few bloody-nose disasters blamed on outdated systems—boards now sponsor the shift. Timelines have shrunk. Expect year-one ROI in the 3–5x range if you pick your battles and govern the data.

Marketing Meets Operations

Now the fun part—revenue. Forecasting precision doesn't just protect shelves; it informs the entire go-to-market machine. When your system detects a likely regional surge, the marketing team can pulse spend with confidence, not intuition. That's where the growth compounding starts.

Think about it: your content strategy should be in conversation with inventory. If the forecast flags a short window where supply is strong and demand is rising, you queue content marketing that steers demand to SKUs with headroom. That's not manipulation—it's alignment. Even SEO optimization benefits: long-tail pages for in-stock variants capture queries the week they spike, not six weeks later. Search intent meets actual availability. Everyone wins.

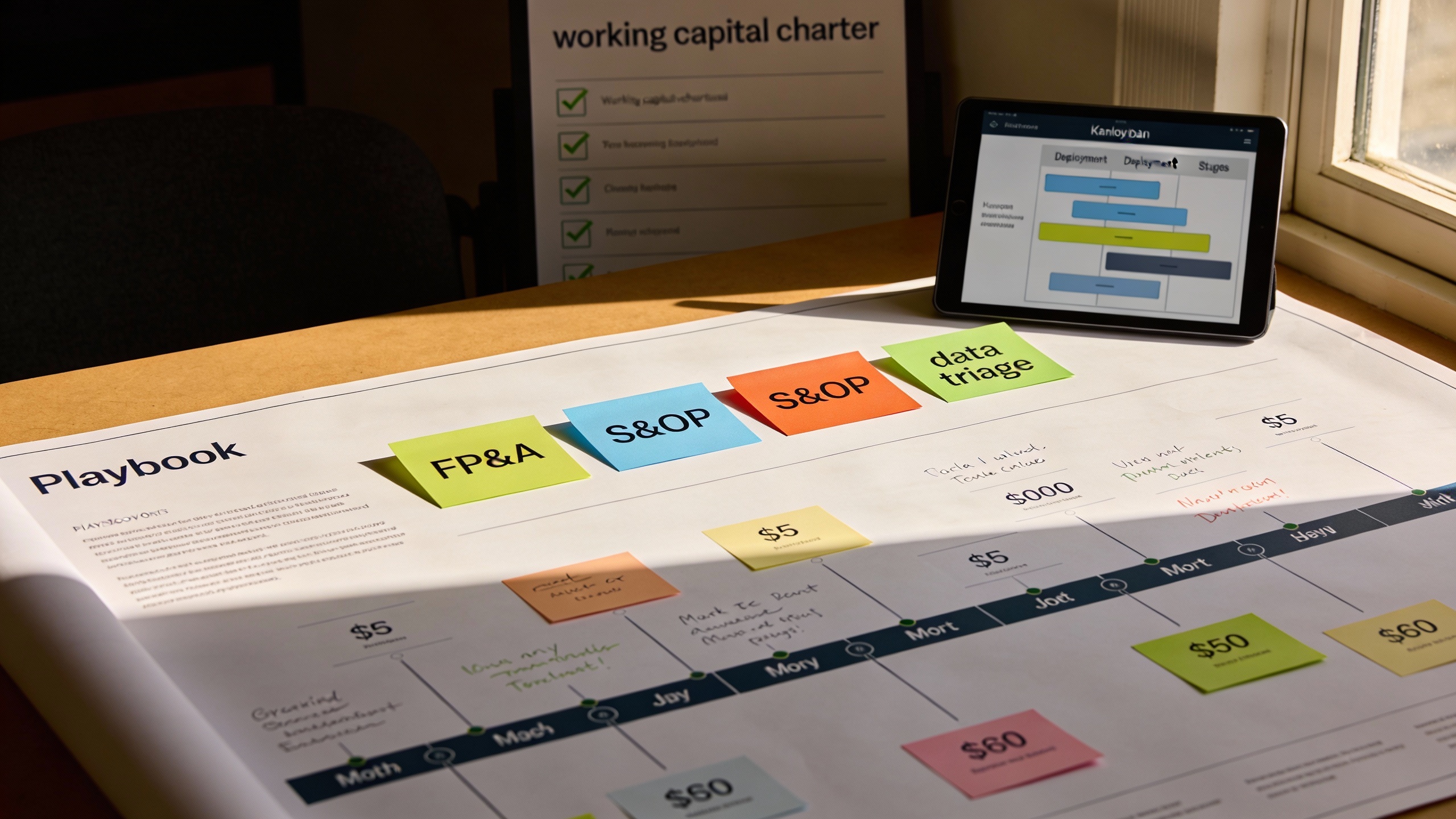

The Playbook: Building an Autonomous Forecasting Loop

- Inventory is a finance story. Start with a working capital charter owned jointly by FP&A and supply chain. Target a dollar figure for cash release with explicit service-level floors by segment.

- Data matters more than model cleverness. Lock in reliable supplier ETAs with API SLAs; instrument key lanes with IoT; fix product hierarchies.

- Ensemble, don't overfit. Use a stable backbone (state space) plus reactive learners (GBMs, transformers). Calibrate prediction intervals obsessively.

- Close the loop. Autonomy without policy is chaos. Define replenishment rules, expedite thresholds, and exception queues.

- Measure relentlessly. Track MAPE, weighted MAPE, bias, service level by decile, turns, cash released, and lost sales recovered.

- Scale with restraint. After two pilot business units prove ROI, roll to adjacent categories with similar demand physics.

You're not buying math. You're buying a cash machine with the discipline to say no—to excess, to hunches, to excuses. When it's humming, the chain stops jerking around and starts compounding value. That's the game.